Surviving Disruption, Part 2: Kodak Died. FujiFilm Thrived. Why?

Nothing in business is simple — complexity dominates.

Hopefully this is one reason my recent writing about Kodak tapped a vein. At the same time, showing that a simple, widely accepted mythology is wrong created some strong negative reactions from those who have embraced the story and the simplified version of the world it represents.

Even the pushback was useful, though. Someone suggested I was wrong about Fuji because they sell digital cameras today. So I took deeper look at FujiFilm’s numbers and it was very interesting. FujiFilm DOES sell digital cameras but that’s not why they survived — it’s a very small part of their modern story.

In the process, though, I compared FujiFilm’s 2001 numbers with Kodak’s in 2001 and FujiFilm’s in 2018 (according to their annual financial reports — links below).

What I found is an important story for any student of business. We need to hear more about what really happens in business.

The Death of the Photographic Film Business

The Death of the Photographic Film Business

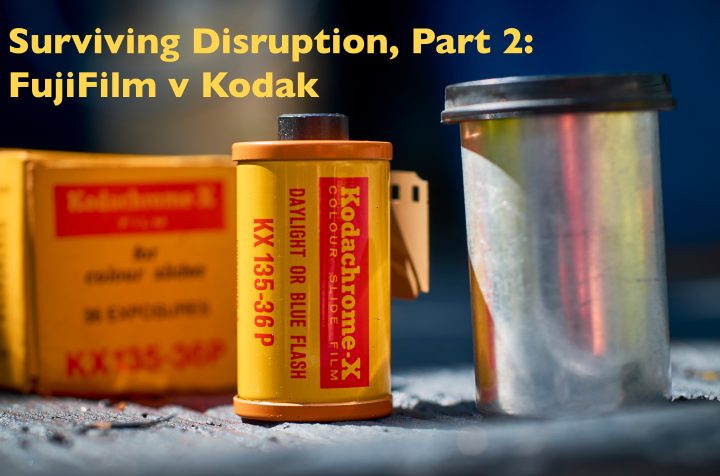

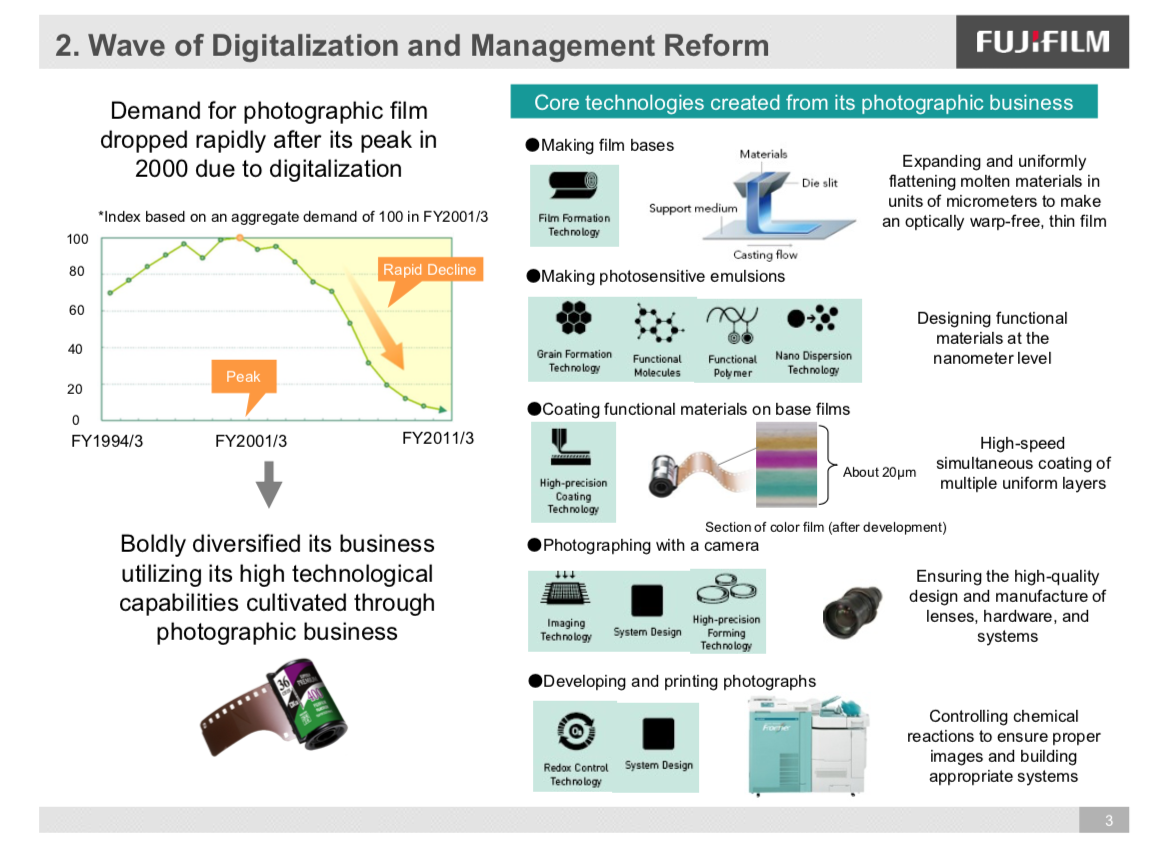

Just to get a grasp of how quickly the film business died, here’s a graph from FujiFilm’s 2018 annual report showing an indexed size of the film market by year. This is an incredible evaporation of a market due to competing technology. (I’ve seen worse. The advent of the fast chip based CPUs put the major supercomputer manufacturers out of business in about 3 years.)

Note, also, that what hit the film business isn’t exactly Christensen disruption — it’s that more popularized version where tech simply leads to dramatic change. Christensen applies his term, after all, to industries who become vulnerable by lading on expensive features that deliver only small customer value — leaving open opportunity for low cost, low feature alternatives.

In the film business, though, cost wasn’t the opportunity. The features that make digital so attractive were new highly convenient features made entirely possible by the new technology.

Based on Fuji’s graph, demand for film decreased by a factor of over 25 in a 10 year period from 2001 through 2011.

The mere presence of this graph in FujiFilm’s annual reporting 18 years later raises an important question: why is the graph still there? My best guess is that FujiFulm execs still get surprised comments like “but we thought you’d be dead just like Kodak!”

The catastrophic market change makes some of that understandable. Yet we can’t excuse enthusiastic disruption promoters jumping (illogically) to the shallow idea that “film companies were troglodytes and they just needed to embrace digital.”

We hear this quite often in the silliness which is that corporations must “disrupt themselves”. Huh. It’s true that corporations need to prepare for major change. But, an aggressive program to seek out low margin business seems quite silly.

But let’s play with the idea. What if Kodak and FujiFilm had decided digital cameras were the way forward?

A Very Brief Life for the Point and Shoot Digital Camera

Both Kodak and FujiFilm aggressively pursued digital cameras. What if they had bet their businesses on digital?

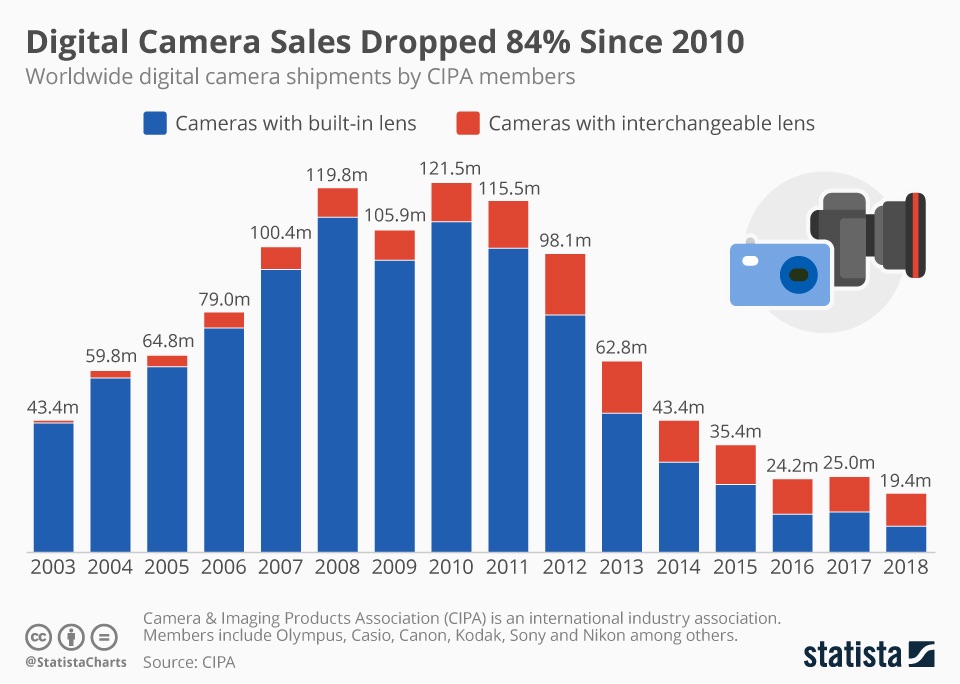

This graph shows digital camera sales (in units) from 2003 through 2018. Looking at this data, had Kodak made a committed move to digital it would have been no more than jumping from one dying horse to another.

I don’t know how much FujiFilm and Kodak anticipated the vulnerability of digital cameras. Most likely what they saw was a dog-eat-dog competitive market. They could also see their brand weaknesses in attempting to compete with better known and trusted camera brands.

But let’s suppose Kodak had made a big digital camera commitment. Consider the following:

- Kodak’s need was to replace their $9 billion film business.

- In two peak years, around 121.5 million digital cameras shipped.

- Only two years saw that many ship.

- Assuming an average retail price of $210 and a 20% margin to the retailer (conservative assumption), then the TOTAL digital camera market for manufacturers would have been $20.4B.

- Kodak would have been unlikely to be able to get more than between 2% and 5% of the market.

In the absolute best case, if Kodak had shifted digital cameras they would have had 2 years (eventually) where they had $500M — $1.0B in sales. Otherwise, they would have been trying to replace a $9B market annually with sales well below $0.5B.

Note: I love that digital SLR sales (removable lenses) increased over this time and appear quite solid. This makes sense — these cameras offer something substantively different from a smartphone. It’s always good to see when market data makes sense with customer realities.

So, how DID FujiFilm survive when Kodak failed?

In 2001, FujuFlim was Far More Diversified than Kodak

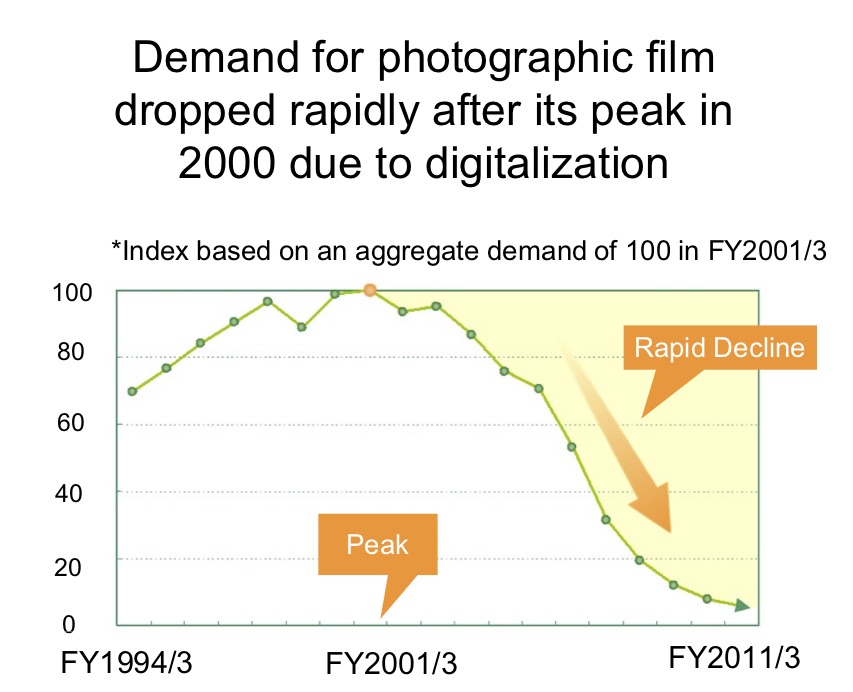

I’ve done what I can in reading annual reports — both companies use highly specific language which can make it tricky to know exactly what’s comparable. But I feel confident that the following is roughly accurate:

While the companies are essentially the same size, 71% of Kodak’s revenue was from photo’s and film compared with only 26% of FujiFilm’s.

While the companies are essentially the same size, 71% of Kodak’s revenue was from photo’s and film compared with only 26% of FujiFilm’s.

Add to this the decay in the film market starting at exactly the point of this snapshot — and Kodak loses over 2/3rds of their revenue in 10 years. FujiFilm loses only a quarter of its revenue. Which business challenge would you rather face?

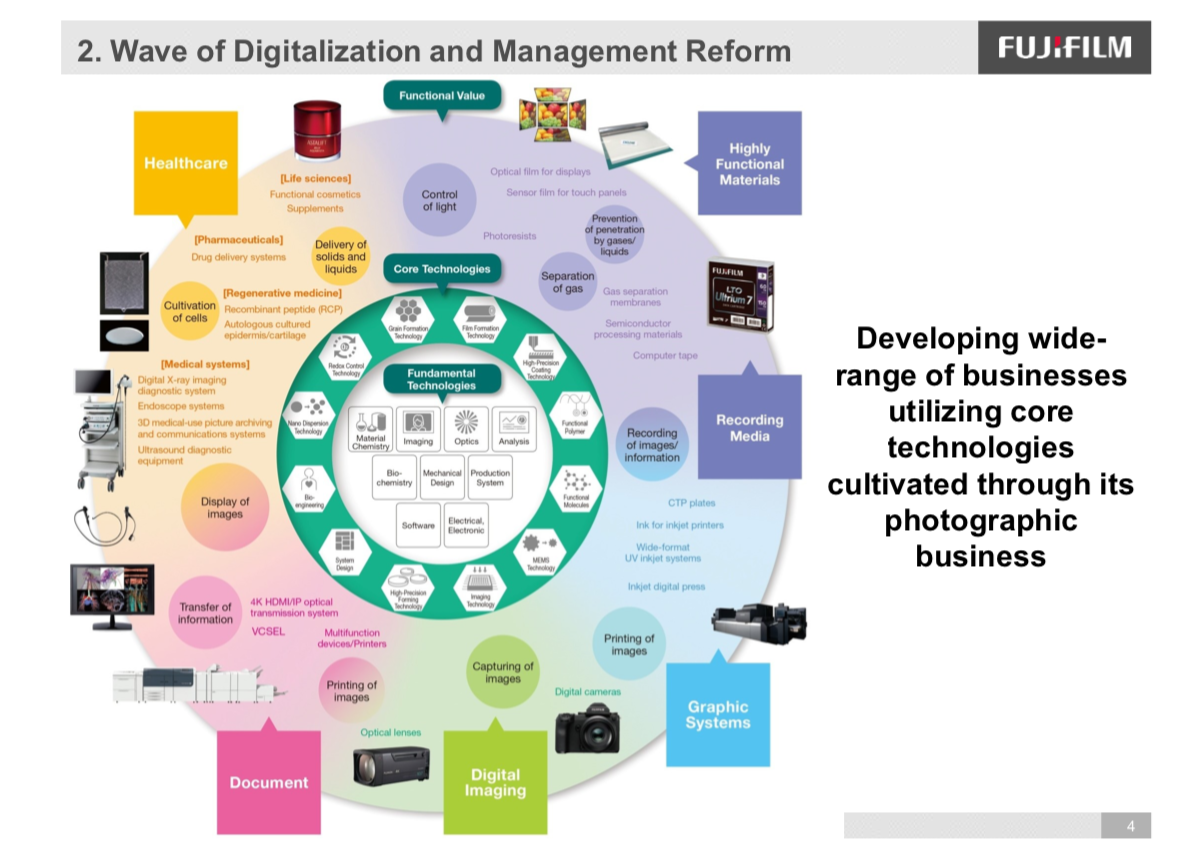

FujiFilm Built on It’s Diversification

FujiFilm’s diverse base of business gave it other areas on which to build. For example, they grew their health market superbly. And Document Solutions? They have had partial ownership in Fuji Xerox for a few decades — and increased it recently. The Fuji management did a nice job, it appears, building on opportunities in hand in order to avoid complete catastrophe.

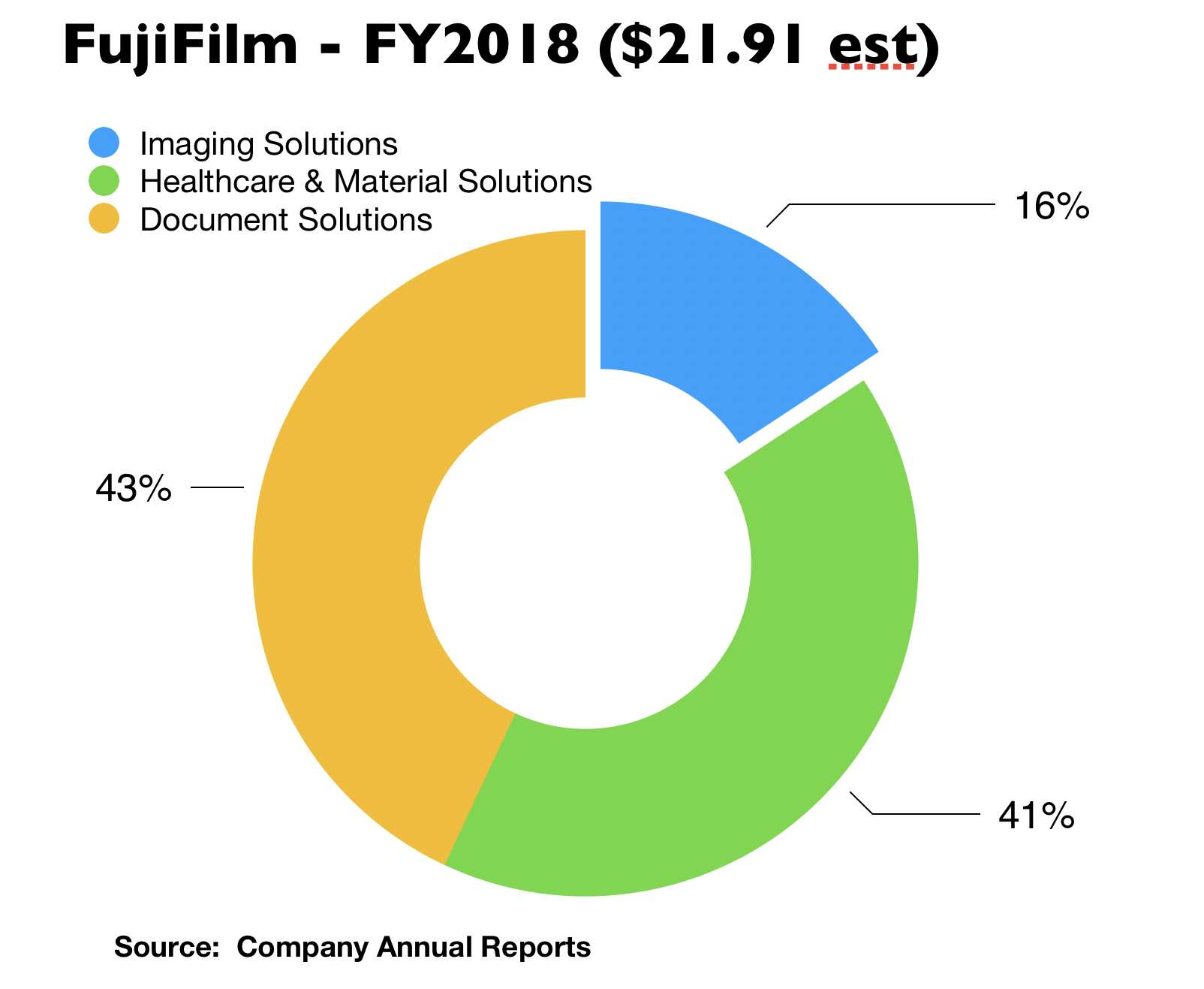

The 2018 FujiFilm annual numbers show revenue has increased from $13B in 2001 to roughly $21B in 2018 — more than the inflation adjusted $18B. All this, despite the film market crash.

Surviving Disruption Usually Means Abandoning a Market

It bugs me when disruption enthusiasts use ideas like “disrupt yourself” to indicate that the best way to survive is to commit to a bad, low margin market. There’s no reasons any company should expect to stick in the same market to survive disruption. How could it…ever? Disruption inherently means a high margin business becomes a lower margin business. It’s a rare company who can quickly switch from one to the other.

Yet, these assumptions are behind claims that Kodak should have dominated the newly digital market of consumers taking photos. I see no evidence anywhere in the history of business to support that idea. Yet we still get consultants selling their services telling us “the company had the nearsighted view that it was in the film business instead of the story telling business.” The evidence doesn’t support that — no matter how well it fits with typical consultant business school pitches. The kind of storytelling Kodak built moved to smartphones without room for Kodak to make money.

On the issue of abandoning markets, it’s been interesting to watch IBM continue despite incredible technological disruption of their core markets. How? They are mostly consultants these days — only 10% of their revenue comes from selling systems. They seem quite fine in this new world.

FujiFilm Followed Film to New, Non-consumer Markets

While disruption enthusiasts seem to demand companies stay within the bounds of their markets, as I wrote last time this is rare — survival happens more often with a market change.

In my prior post, I linked to an article about FujiFilm discussing the very, very high end applications for film they found — and an area where they built a strong business. After deeper research, I fault the article for suggesting this is the primary reason why they survived. Instead, I’ll just observe it was a very, very smart business move as part of their overall strategy.

Here’s what the 2018 annual report says about that business. Note that much of the evolved “film” business is lumped into Healthcare and Material Solutions while the Imaging Solutions category contains consumer cameras, printing services, replaceable lens cameras, and high end lens (e.g. for TV production).

Here’s what the 2018 annual report says about that business. Note that much of the evolved “film” business is lumped into Healthcare and Material Solutions while the Imaging Solutions category contains consumer cameras, printing services, replaceable lens cameras, and high end lens (e.g. for TV production).

FujiFilm Makes Digital Cameras, but It’s Tough Market

I don’t think I need to say much about this. The above tells it all — the massive loss of digital camera opportunity except in the very high end SLR market. It’s quite unlikely either Fuji or Kodak could have established strength in those markets where lens compatibility and other features build incredible brand strengths.

In fact, when you rank interchangeable lens cameras, Canon, Nikon, and Sony dominate. FujiFilm has only a small market share — although it may have localized strengths internationally where I’m less familiar with the markets

Disruption is Survivable by Many Companies

What lessons shall we take from all this? First, don’t believe easy answers — even in a TedTalk. These are NOT simple topics. Using Rick Nason’s terminology, let’s also admit that disruption isn’t a good place to apply complicated answers either. When it comes to disruption, complexity rules.

Second, disruption can be survived — it’s not entirely the catastrophe many presume. Kodak’s problem was lack of diversity — they simply didn’t have enough other businesses strong enough to build on. FujiFilm had those businesses and survived.

I should also re-emphasize that to survive you need to be prepared to abandon your market. The value of company survival to shareholders, as many employees as possible, and customers far outweighs any ego driven need to stay within a given market.

Nothing in business is simple — complexity dominates. Let’s go forth and embrace complexity.

FujiFilm Annual reports (including the PDF where I pulled the included charts) may be found at this link to their investor page.

Kodak’s 2001 Annual Report can be found at this link.

©2019 Doug Garnett — All Rights Reserved

Through my company Protonik LLC based in Portland Oregon, I advise a select group of clients to drive success with better marketing of new and innovative products. I also work with clients attempting to bring new life to Shelf Potatoes or take their existing products to new markets. You can read more about these services and my unusual background (math, aerospace, supercomputers, consumer goods & national TV ads) at www.Protonik.net.

Categories: Business and Strategy, Complexity in Business, Consumer Electronics, Innovation

Posted: February 8, 2020 22:45

Surviving Disruption. Kodak Storytellers Get It Wrong; Things We Can Learn from Kodak, Fuji, Supercomputers and NordicTrack. | Doug Garnett's Blog