A Skeptic Considers Amazon Q2 Results: The Reports We Get aren’t the Reports We Need

Where a cynic disbelieves on principle, a skeptic wants to know the truth and challenges when the truth is unclear.

Those who around me know that I am an Amazon skeptic — one who orders plenty from their store. I’m a skeptic because Amazon seems to methodically hide reality and their investors let them get away with it.

Truth is, Amazon does bring in vast sums of cash. Where I seem to differ from most of the world is I don’t think we should be blinded by their use of big numbers to avoid questions. (That said, I do imagine Bezos’ counting all that cash in the dungeon of some Seattle building like Scrooge McDuck).

Inside the Mind of a Skeptic

Yesterday’s Amazon reports led with two headlines:

A massive spike in revenues — a jump from $63B in Q2 2019 to almost $89B in Q2 2020. Impressively big.

A seven fold over-delivery in promised profit per share (although slightly less than double the prior year despite the big revenue jump).

Let’s start here: Overdelivers on a promise? They beat expectations?

Expectations are a gambler’s game. Had expectations been set too high, they would have missed expectations yesterday. It’s even entirely possible they knew they’d do far better and set low expectations in April. This is even more likely as it would be reasonable to do given the complexity of the pandemic economy.

What we know for sure is this: Beating expectations they’d set is not necessarily a massive achievement. And while there are still a few people around who believe the stock market is infallible, the rest of us know the stock market has no wisdom — just a lot of chasing around after bets. (Like, would you have bet that Kodak’s dismal stock would jump from $2.50 to $32.00 in the past couple weeks? I didn’t. Wish I had.)

What isn’t said in their focus on estimated profit?

Here are some facts I found:

- In North America, while they had a revenue boost, their margin on the added revenue was lower by over 10%.

- In AWS, their profit percentages increased during this time.

- Their international profits did nicely — but they continue to hover around break even. The profits are small enough that book keeping might have swung them negative or positive.

So where does their profit come from? As shown in this table, it comes from where it’s always come from — AWS. While there is a slight increase from the two operating geographies, the net isn’t tremendously significant. In fact, AWS has hovered for several years between 55% and 75% of profit — with only 10% or so of revenue.

The Missing Data: The Regional Segments Hide What Really Happens

Investors should demand that Amazon split out their North American and International Sales into more useful segments. The ones which I have wanted to see separated are Amazon invented and manufactured device (IP), advertising (it’s high margin) and retail-like sales mostly through their online store.

What’s missing in today’s breakdown is a separation of physical and online retail. However, while we know Amazon store revenue was around $4B, we don’t have retail profit numbers. And I do not feel comfortable estimating store profits during this pandemic environment.

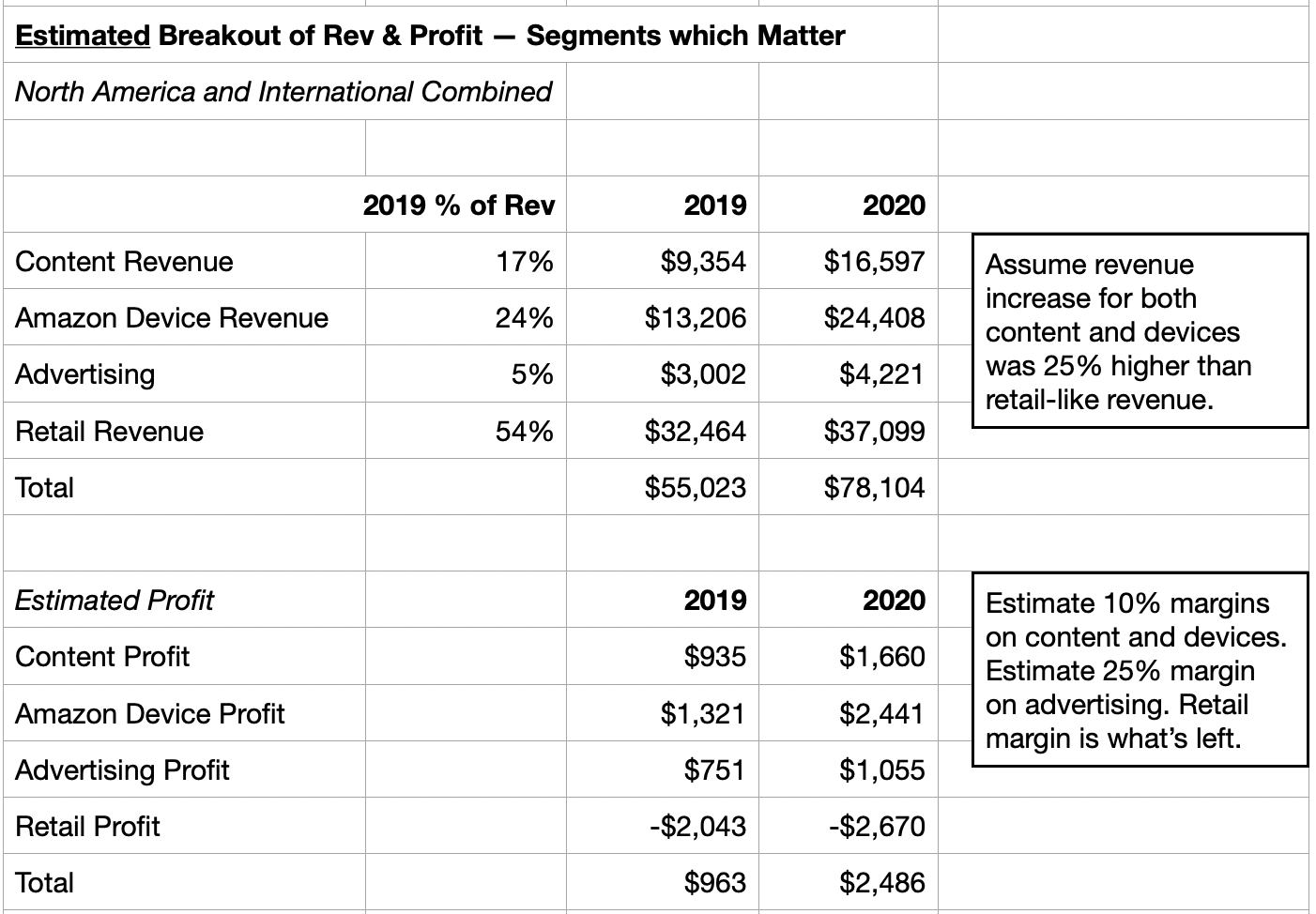

The following is an estimate of this more truly useful breakdown of segments with profits based on years of watching Amazon. All is estimated because Amazon doesn’t report clearly enough. Note that the revenue percentages are purely looking at this NA/International combination.

In developing these estimates, I chose to assume that revenue for content and devices outpaced retail in growth. This appears reasonable by thinking of the types of things people are buying during the Pandemic.

Further, I assumed that content and devices have better margins than retail-like sales. We don’t, of course, know their actual margins. But even assuming a 10% margin for content and devices, Amazon doesn’t have a chance of making money on their retail-like sales. And advertising should be a very high margin business. So I’m hopeful that a 25% margin (lower than AWS) is a reasonable assumption.

Amazon must be getting pressure on this issue — because they have begun reporting revenue according to the following categories. That said, it’s suspicious that they don’t report profits by these categories.

-

- Online stores

- Physical stores

- 3rd Party Seller Fees

- Subscription Services

- AWS

- Other (primarily Advertising)

The Myth of Amazon Revenue

If I am anywhere close to right with my estimates, we should all ignore Amazon revenue claims. Consider:

- They get more than 50% of their profit from 12% of their revenue. And they have done this for years. Years.

- Around 1/2 of their revenue returns NO PROFIT. In fact, despite years of haggling their vendors, Amazon has not been able to turn retail-like sales into profit.

- Where they get profit is not where Bezos started (“In your margin is my opportunity”) but with high margin businesses

A final note on revenue is to remember that we’re haggling over tiny profit margins for a company of Amazon’s type. Apple, Google, and Microsoft see margins between 25% and 35% — not Amazon’s relatively minuscule 4-7%.

The Mythical Free Cash Flow

Free cash flow is serious and important — until you have used it, like Amazon, for 20 years as the foundation of telling the market “we’re healthy”. They are now at a point where it would be very difficult to shift to becoming a more traditional company.

I have concerns with free cash flow reporting. In their early days, their free cash flow growth required constant growth in revenue because they were holding onto cash owed to vendors who supplied product. Not unusual in retail. But this is a dangerous game. A series of quarters with lower growth could reveal Amazon to be a house of cards — with financials that would collapse quite quickly.

Lately, their free cash flow reporting has changed a bit. Now, as they drive AWS expansion by purchasing, developing and leasing property, all kinds of costs can be buried to make free cash flow look “just right.”

Is there something to worry about in their dependence on free cash flow? I don’t know. But it does seem one of those Zen opportunities — where a company’s strength also turns out to be their weakness. This is an incredibly common reality.

So, for me, their continuing to rely on Free Cash Flow as the lead in their presentations raises concerns. While it shows good numbers, their dependence on it might be lead investors to ignore serious weaknesses or risk.

Amazon PR: Masters of Prestidigitation.

I wish more of the world realized that Amazon’s PR department is filled with PR magicians. Some days I wonder if there’s a special ray Amazon emits to cause otherwise sane business people to forget that the role of the PR department is to manipulate the world with information. Oops. I’m sorry. Manipulate is a harsh word. How about this? It’s the role of PR to control the narrative around a release — carefully managing information to leave the impression which is most useful to Amazon.

Half the time, Amazon PR uses “high profile” surprises or big promises to distract us (remember drone delivery?). The rest of the time, they use the myth of “big numbers” to baffle the markets with bullshit. And it works. Their ever increasing stock price avoids having investors choose to ask tough questions.

What I would like, instead, are simply good reports about the business. How much longer can Amazon hide the miserable financials of their retail business? I suppose as long as investors continue to get returns they don’t want to challenge.

Stay safe.

©2020 Doug Garnett — All Rights Reserved

Through my company Protonik LLC based in Portland Oregon, I consult with companies on their efforts around new and innovative products and explore what marketers should learn from the field of complexity science. An adjunct instructor are Portland State University, I also teach marketing, consumer behavior, and advertising.

I also advise a select group of clients attempting to bring new life to Shelf Potatoes or taking existing products to new markets. You can read more about my unusual background (math, aerospace, supercomputers, consumer goods & national TV ads) at www.Protonik.net.

Categories: Business and Strategy, marketing, Retail